Why a Data Market?

We are all very aware for the promise of big data. Companies, organizations, governments, and individuals can all make smarter decisions faster. The big data revolution promises to make us all smarter and more productive. However, 90% of data still remains inaccessible.

Why? I think the answer to this question largely has to do with incentives.

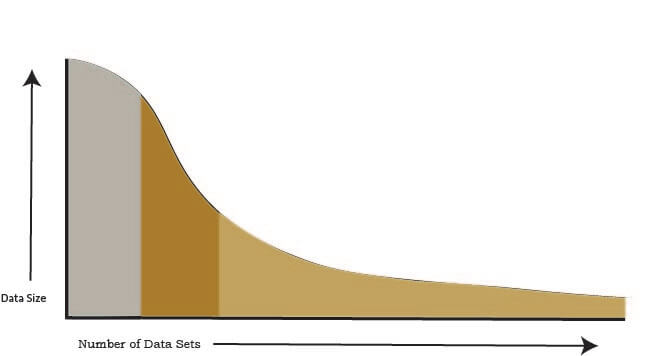

So called big data is distributed across millions of entities and individuals. However, very few of these players get an economic gain from their data. More savvy companies are able to leverage their data to increase sales and become more efficient. Researchers at Harvard Business School estimated that data driven companies were 5% more productive and 6% more profitable on average than their competitors1. Still few players have developed highly profitable business models based largely on utilizing their data. For Alphabet’s Google and Facebook, big data isn’t just a means for improving business, it is the business. It makes complete sense for these players to be very focused on organizing and utilizing their data, however all of these incentivized players still own less than 10% of data.

The other 90% of data owned out there is owned by players that have much less economic incentive to utilize their data. Because there is not much incentive for these players to do anything with their data, much it remains unstructured and often completely ignored.

The Trouble with Acquiring Data Today

Google, Facebook, and other companies’ data acquisition business model has been about collecting as much data as possible by essentially bartering for it (e.g. you give Google your every desire, they give you great search results). This business model is effective for obtaining consumer data, however it breaks down when both sides lack something to barter (or can easily find a bartering partner). Data that is highly unique and/or valuable can often be difficult to barter. Thus, a big reason 90% of data is still unstructured and inaccessible is that it cannot be easily bartered.

So why don't the well funded, led, and highly motivated players go out and try to acquire this data? Mainly because its really, really difficult. First, the data is distributed across millions of mostly private entities and individuals. How do you identify much less contact all of these players?

Next, how do you identify what data you want since a lot of this data will have limited value? Because much of this data has limited value to its current owners, it is going to be largely unstructured and in multiple file formats. If the current owners don't know what they have, how would outside parties be able to determine it?

Finally, if you figure out how to efficiently tackle theses problems, how do you actually transact the data? Determining a fair price would require negotiating, which requires time, which is costly. Oh, and how do you handle privacy concerns across countries and U.S. states?

The reason over 90% of data remains underutilized (if not completely ignored) is due to some simple math: the costs of acquiring this data are greater than the value of the data.

The Need for a Data Market

There’s two basic ways we can change this calculus. The first is to increase the value of data and the second is to reduce the search and transaction costs associated with acquiring data.

The simplest way to increase data value while reducing data acquisition costs is creating a data market. A data market:

- Increases the value of data by providing a efficient way to market and sell data. A single data market draws more data buyers means more data demand.

- Decreases search costs by providing buyers a single, uniform presentation of data available for sale.

- Transaction costs are reduced by providing effective governance of data transactions.

Across history, the exchange of any commodity progresses from bartered exchange to market exchange as demand for the commodity increases. The Economist recently called data “the most valuable resource.” We think it’s high time for a data market.

Data & Sons

We created Data & Sons to provide the economic incentive necessary to free up, organize, and exchange a great deal of the world’s data. Freeing up all of this data will increase the speed of new knowledge development and create new revenue streams for millions. The Data & Sons’ data set exchange solves most of the problems surrounding data exchange:

- A single market place for data sellers and buyers to meet and exchange data of all kinds.

- Buyer demand creates incentive for potential data sellers to organize and sell their data.

- Our easy to use data set upload process gets all data in a uniform format (csv) making it easy to exchange and aggregate.

- We review all data set before posting on Data & Sons to ensure the data complies with our Personal Privacy Policy limiting exchange of personal information.

- We safe guard all transactions on Data & Sons limiting the sale of fraudulent data sets.

We hope you agree and choose Data & Sons. A smooth, secure, and just plain smart way to exchange data.

Cheers,

Sean Lux, Ph.D.

CEO & Co-Founder

Data & Sons

1Big Data: The Management Revolution

Andrew McAfee & Erik Brynjolfsson

Harvard Business Review (Oct, 2012)